|

|||||||||||

|

|

|

|||

|

By |

||||

|

September 3, 2010

- In April Continental and United Airlines negotiated a merger and on

May 3, 2010, United and Continental announced an agreement to merge the

two airlines. The new airline would retain the United name and

headquarters in

The merger would

be financed exclusively through an all-stock transaction with a combined

equity value of $8 billion split roughly with 55 percent ownership to

United shareholders and 45 percent to Continental shareholders.

One of the primary

financial benefits that airlines consider when merging with another

airline is the cost reduction that may result from combining

complementary assets, eliminating duplicative activities, and reducing

capacity. A merger or acquisition could enable the combined airline to

reduce or eliminate duplicative operating costs, such as duplicative

service, labor, and operations costs—including inefficient (or

redundant) hubs or routes—or to achieve operational efficiencies by

integrating computer systems and similar airline fleets. |

|||

| Continental Airlines Chairman, President and CEO Jeff Smisek | ||||

|

|

||||

|

In June a consumer

group filed a lawsuit in

On Tuesday, in

court, a lawyer representing the consumer’s in their suite, Joseph

Alioto, questioned Smisek on an internal document “Hub Stats” which

indicated under a Continental United merger scenario “I hope we will keep all our hubs open but I can’t guarantee that,” Smisek further stated under questioning from the lawyer for the airlines, Tim J. Coleman that the merger would result in the loss of 1,500 to 1,800 employees. This would include frontline employees such as airline attendants, reservation agents and pilots.

The media reported

Tuesday’s court hearing and as a result Continental Airlines Chairman,

President and CEO Jeff Smisek came out on Wednesday stating that the

media has “Distortion Of Facts.” Continental reported that it is

commitment to |

||||

|

“Continental is

firmly committed to

Smisek joined the

airline in March 1995 as senior vice president and general counsel. In

December 2004, he became president and was elected to the company's

board of directors. He became president and chief operating officer in

September 2008 and assumed the role of chairman, president and chief

executive officer in January 2010.

The reports were

based on one of many simulations analyzed before the merger was

announced, and modeled the most severe recession or disaster scenario.

The simulation was promoted by the plaintiffs’ attorney in the trial of

a lawsuit filed in

“Other simulations

showed

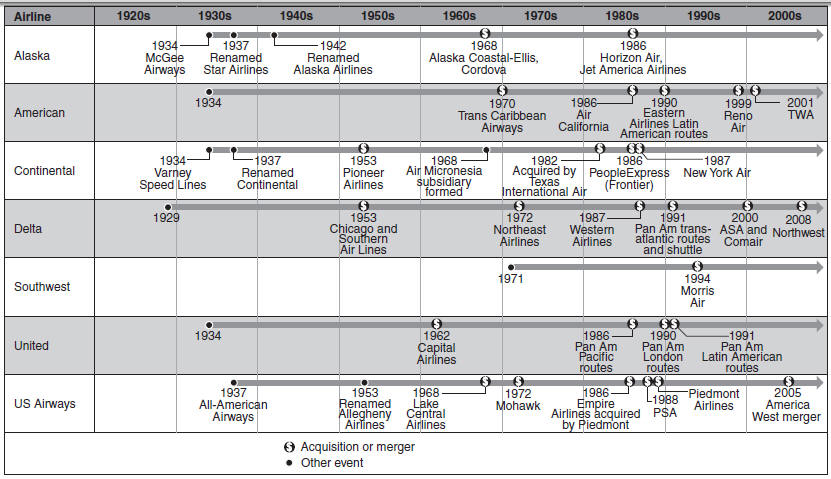

Since deregulation in 1978, the financial stability of the airline industry has become a considerable concern for the federal government owing, in part, to the level of financial assistance it has provided to the industry by assuming terminated pension plans and other forms of assistance. Between 1978 and 2008, there have been over 160 airline bankruptcies. While most of these bankruptcies affected small airlines that were eventually liquidated, 4 of the more recent bankruptcies (Delta, Northwest, United, and US Airways) are among the largest corporate bankruptcies ever, excluding financial services firms. During these bankruptcies, United and US Airways terminated their pension plans and $9.7 billion in claims was shifted to the Pension Benefit Guarantee Corporation (PGBC). Furthermore, to respond to the shock to the industry from the September 11, 2001, terrorist attacks, the federal government provided airlines with $7.4 billion in direct assistance and authorized $1.6 billion (of $10 billion available) in loan guarantees to six airlines. Although the airline industry has experienced

numerous mergers and bankruptcies since deregulation, growth of existing

airlines and the entry of new airlines have contributed to a steady

increase in capacity, as measured by available seat miles. Although one

airline may reduce capacity or leave the market, capacity returns

relatively quickly. Likewise, while past mergers and acquisitions have,

at least in part, sought to reduce capacity, any resulting declines in

industry capacity have been short-lived, as existing airlines have

expanded or new airlines have expanded. Capacity growth has slowed or

declined just before and during recessions, but not as a result of large

airline liquidations. Most recently, U.S. airlines responded to volatile

fuel prices and then a weakening economy by cutting their capacity,

reducing their fleets and workforces, and instituting new fees, but even

with these actions, the airlines experienced over $5 billion in

operating losses in 2008 before posting an operating profit of about $1

billion in 2009. Furthermore, over the last decade, airfares have

generally declined (in real terms), owing largely to the increased

presence of low-cost airlines, such as Southwest Airlines, in more

markets and the shrinking dominance of a single airline in many markets. |

||||

|

|

||||

| Other News Stories |

||||

| ©AvStop

Online Magazine

Contact

Us

Return To News

|

||||

|